A commercial conflict involving Egypt’s state grain buyer has intensified scrutiny over the way the country has handled imports since abandoning its long-standing public tender system.

According to two people with direct knowledge of the matter, a Ukrainian supplier loaded roughly 12,000 metric tons of sunflower oil in July under an agreement with Future of Egypt, the military-linked agency now responsible for strategic purchases. The cargo left port without the standard financial guarantees, and the payment expected from the agency never arrived.

Faced with the loss, the supplier turned to a UK-based trade institution that handles commercial disputes between exporters and buyers. It remains unclear whether the case advanced through the institution’s internal procedures or was addressed informally between the parties. One of the associations contacted for this story said it had no open case involving Future of Egypt.

The episode is one of several that have unsettled global traders over the past year. In another case, a French wheat exporter warned of legal action after waiting months for the agency to open a letter of credit for a May shipment. The cargo was eventually loaded in July, after the financial guarantee was issued, but only with added demurrage costs.

For decades, Egypt relied on an open tender system run by the General Authority for Supply Commodities (GASC), which offered transparency and predictable payment terms. The shift to direct, informal negotiations under Future of Egypt has changed that dynamic.

Six international traders said agreements are now often made privately, sometimes by phone, and followed by delays, attempts to change prices after global markets move, or requests to postpone previously confirmed deliveries.

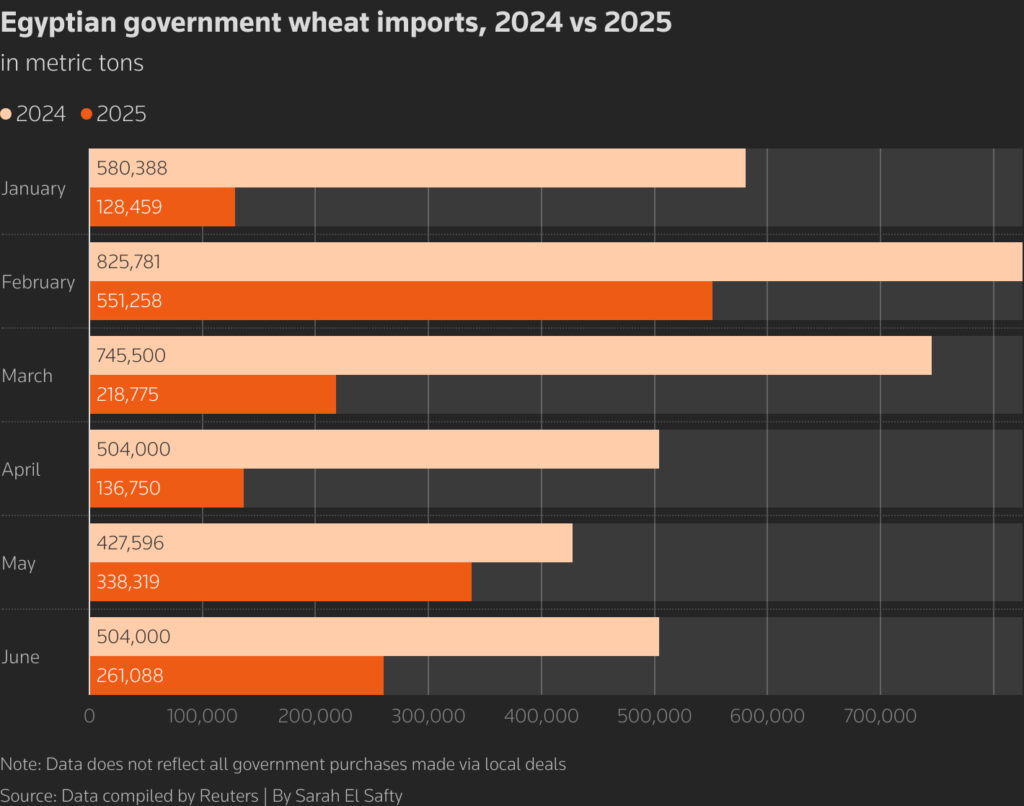

These practices contributed to a sharp drop in state wheat imports in the first half of 2025, pushing stocks to their lowest level in years. At one point in April, Egypt held barely over a month of supplies in storage, according to one trader and a second person familiar with internal records. The shortfall eased only when the domestic harvest arrived.

Some confidence has been restored since the recent appointment of Yousria Yusry Mohamed, a former GASC official, to supervise international purchasing. Several suppliers say recent payments have been released more smoothly, and the agency has resumed placing orders with some of its long-standing partners.

Still, caution prevails. One executive at a major global supplier said his company is withholding new deals until it sees repeated evidence of timely payments, firm commitments, and clear guarantees before vessels are loaded. For a country that depends heavily on imported grain to feed tens of millions of people, that trust is as essential as the commodities themselves.