Kosmos Energy (KOS.N) announced on Tuesday that an arbitrator based in Paris has ruled in favor of BP (BP.L), prohibiting Kosmos from selling liquefied natural gas (LNG) from the Greater Tortue Ahmeyim (GTA) project, located offshore Senegal and Mauritania, to third parties.

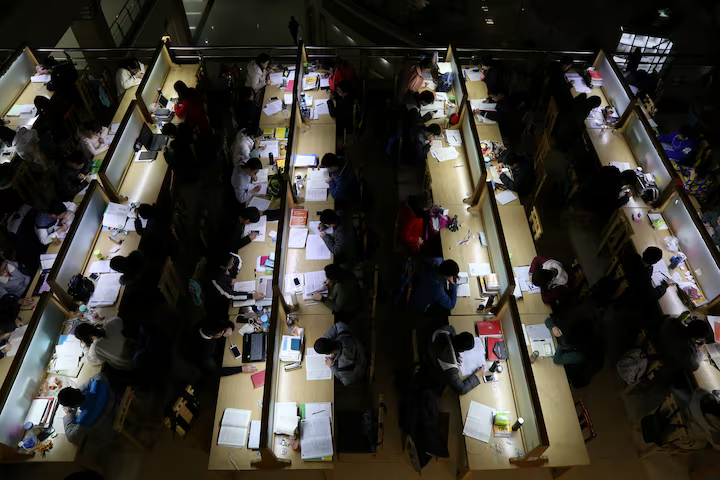

LNG is a core component of BP’s global strategy, playing a critical role in its energy transition plans. The company has developed a significant LNG portfolio worldwide, with Sub-Saharan Africa emerging as a major source of future LNG exports. Countries such as Nigeria, Angola, Cameroon, and Equatorial Guinea are already substantial exporters of LNG.

The arbitration between Kosmos Energy, a U.S.-listed oil and gas exploration firm, and BP Gas Marketing, a subsidiary of BP, was initiated in 2022 at the International Chamber of Commerce (ICC). The dispute centered on the planned sale of LNG from Phase 1 of the GTA project. Kosmos was notified by the ICC that the final and binding arbitral award prohibits the company from selling LNG cargoes to third parties during the term of the sales agreement, which is currently set to expire in 2033.

Kosmos stated that this arbitral decision does not alter the terms of the existing LNG sales agreement nor does it materially impact its long-term financial outlook or operational expectations.

BP, holding a 56% stake in the GTA project, serves as the project operator, with its subsidiary being the sole offtaker of the 2.5 million metric tons of LNG produced annually under a 20-year contract.

In a November 2023 update, BP confirmed that the GTA project was approximately 90% complete and anticipated to commence operations in the first quarter of 2024, following a slight delay from its original schedule.

On Tuesday, Kosmos Energy’s CEO, Andrew Inglis, reiterated during the BloombergNEF conference in London that the project remains on track to begin operations by the end of 2024. Kosmos holds a 26.8% interest in the project.

In parallel, BP, Shell (SHEL.L), and other energy companies are currently engaged in litigation with Venture Global LNG, accusing the U.S. LNG producer of breaching its supply obligations under contractual agreements, while exporting over $18 billion worth of LNG. This legal challenge was filed with U.S. regulatory authorities.

This case underscores the increasing significance of LNG in global energy markets and the legal complexities associated with long-term LNG sales agreements in major infrastructure projects such as GTA.